Algorithmic Trading uses automated pre-programmed trading conditions to execute orders in real-time in stock exchange. Since last decade, algorithmic trading has gained prominence in markets and they’re efficiently utilising industry inefficiencies for their very own benefit. Automation could be the natural passage for almost any technology in future. Since investment is a process it’ll translate better into Algorithmic Trading. Despite Algo trading being in incipient stage in India, it comprises nearly percent of the overall trading. The amount is highly low, as compared to the markets where more than percent of the trades at higher volumes are done using algorithms. The market provides a reasonably good chance for Algo traders having its smart order routing system, co-location facilities and sophisticated technology at both major exchanges, stock exchanges which can be well-established and liquid. Make a search on the below mentioned site, if you’re looking for more information regarding prorealtime forex.

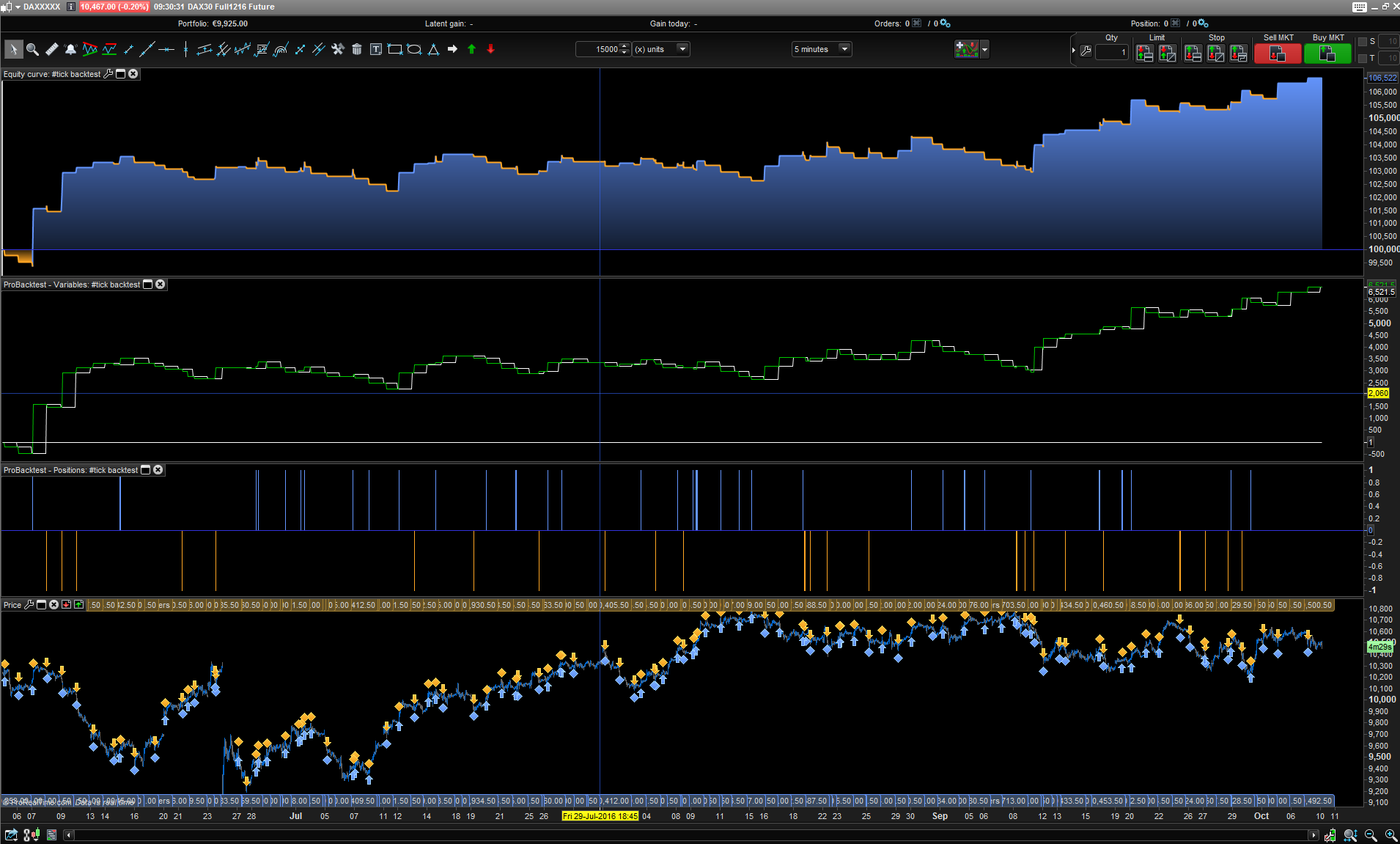

The marketplace is dealing with the growing trend of and demand of HFT and Algorithmic Trading by educating its members in regards to the technology. It can be helping them develop the skill sets required to simply help them understand the complications in trading.For the Algo trading scenario, experts claim that expect highly sophisticated Algo development, but likely centered on a relatively small number of liquid stocks. Liquidity will define the success of the effort. Regulatory issues could mushroom “.Mr Gula develops and deploys databases on equities, futures, ETFs, and has generated, managed and used financial databases. Identifying the proper stocks driving the marketplace study and understanding the whole market, Understand the ways of old traders and extract information, Create specific market rules to drive the algorithms on the macroscale scale, Create tailor-made algorithms per each stock for the frequently traded stock. Speed is of the essence where HFT executes trades in sub-milliseconds – traders will need algorithms and solutions that provide low latency and faster computation. With the further evolving of the market every day, statistical models require constant tweaking.

It is apparent that algorithmic trading is utilized by the investors to customize algorithms and automate their trading strategies to control their objectives. There’s also the use of artificial intelligence solutions with the ability to conform to changing markets. These systems will have the ability to make use of news, satellite images, social media marketing feeds, etc. to predict market trends. However, the introduction of Algo trading in stock markets – one of the most liquid open markets on the planet is trying to a betterment of the trading market. India can very quickly open as much as foreign investors who’d choose Algo trading in a big way. Algo trading is quickly becoming the continuing future of the markets, with its minimal cost and risk in executing an order.Investors are constantly searching for new investment strategies that take the guesswork out of an investment. They desire it to be a high-yielding, low stress approach; one which minimizes risks and maximizes profits on every deal. Algorithmic trading systems were developed along these lines. algorithmic sounds such as for instance a heavy term to digest, but it is not. We will give you a quick summary of algorithmic trading and its varied types.