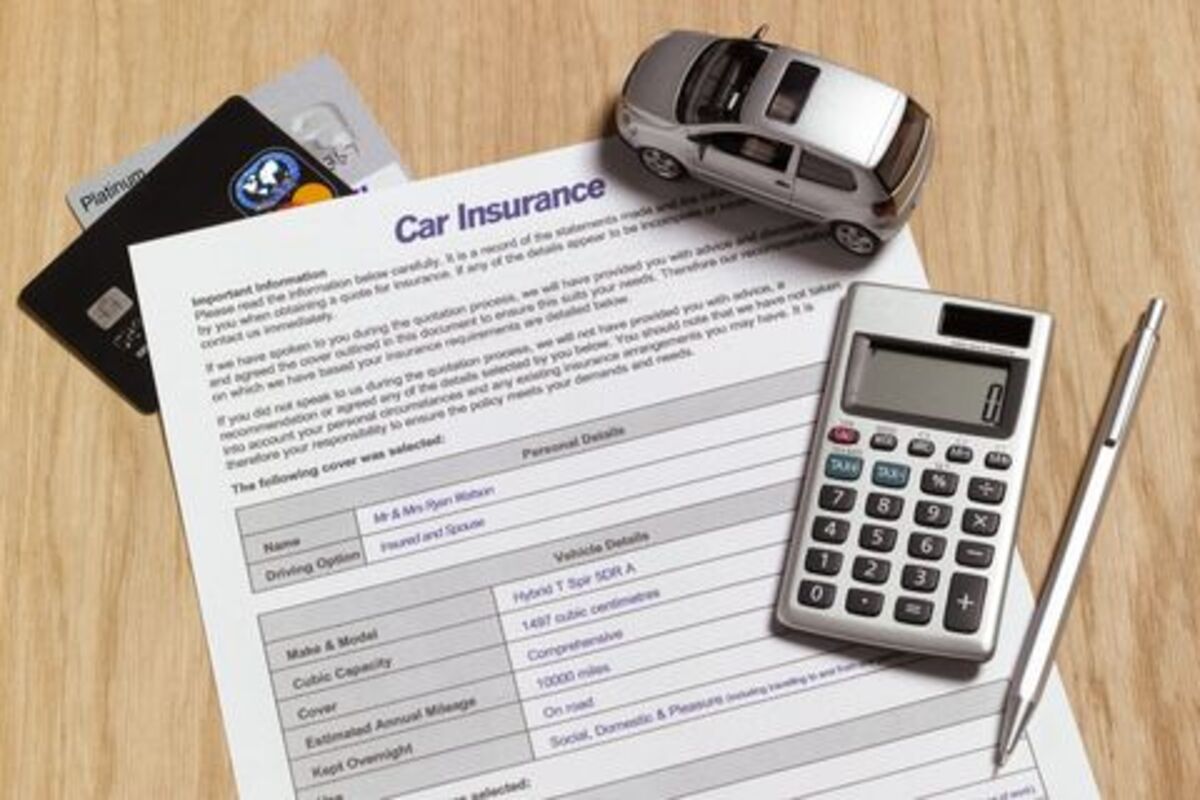

Currently, every individual is required to possess a car insurance policy. A number of countries have made compulsory that their citizens own a motor-insurance policy. There are two types of car insurance policies: comprehensive and third-party. These two forms are very different. You must decide what your needs and requirements are. Motor insurance is offered by car insurance companies. Having a car insurance policy offers several benefits to individuals. Motor insurance protects individuals against vehicle damage, theft and loss. Besides, the policy also covers the loss that occurs during transit. Car insurance is a great protection for individuals in case of road accidents and mishaps. Car insurance covers the cost of any damages that may have occurred in an accident or other unfortunate circumstance. The motor insurance policy provides financial protection and a fixed amount.

Additionally, the policy offers many discounts, add-ons, features and other benefits. There are many options available to choose the right type of insurance policy for your needs. As we have already mentioned, car insurance policies can include different features. The offers of each company may differ. Hence, it is imperative to find an ideal car insurance company. Once the vehicle is damaged, car insurance companies will be liable. When the vehicle is damaged, the insurance company can take it away and fix it. The damaged part must be repaired qualitatively and properly. When searching for car insurance companies, individuals should also consider the network of mechanics and garages that the company offers. Repair services are vital and the company should offer top-notch services to its customers. An insurance contract is built upon trust. Insurance companies should provide exceptional services in case of damage. Cashless transactions should be encouraged when utilizing the repair services. The car insurance policy covers third-party liabilities. If you’re looking to learn more about car insurance companies, go to the previously mentioned website.

This is the most secure type of insurance policy due to its inclusion of third-party liability insurance. Sometimes, an accident on the road or mishap can cause bodily injury to third parties. In such cases, there is often a legal battle. The roadmap to win a legal action is a costly affair, and thus finances are drastically lost. Financial savings can be made if one has an insurance policy that covers car repairs. People should consider third-party coverage over comprehensive policies. Car insurance companies offer multiple offers while providing a motor insurance policy to their customers. However, the market is loaded with numerous companies, and an individual may get confused while selecting the best option for themselves. The overall process should be considered when searching for car insurers. The claim process should be quick and easy. Car insurance companies must also provide excellent customer support in times of need. So, the best car company is one that provides instant claims processing and minimal paperwork.